How Federated Funding Partners Bbb can Save You Time, Stress, and Money.

Table of ContentsHow Federated Funding Partners Legit can Save You Time, Stress, and Money.The Buzz on Federated Funding Partners ReviewsSome Known Details About Federated Funding Partners Reviews Not known Details About Federated Funding Partners Bbb

When you remain in a placement to do so, an option to minimize that expense is to make use of the cash you will be saving to pay extra on your financing each month and pay the funding off earlier, thereby saving some money on rate of interest throughout the financing.

Closing your debt cards will trigger your credit utilization rate to enhance, which can harm credit history - federated funding partners legit. The creditor may likewise include a declaration to the account that shows the payments are being managed by a financial obligation consolidation company. This declaration might be seen negatively by loan providers that manually examine your record.

Even though the debt consolidation business will certainly be making settlements in your place, you will still be accountable for making sure those repayments are made to your lenders on schedule. If the debt loan consolidation firm stops working to make a payment promptly, the late repayment will certainly be assessed your credit report.

The 2-Minute Rule for Federated Funding Partners

Before entering right into any kind of financial debt loan consolidation plan, study the deal to make sure that the business is trusted which you completely recognize the terms and effects of the program. Thank you for asking,.

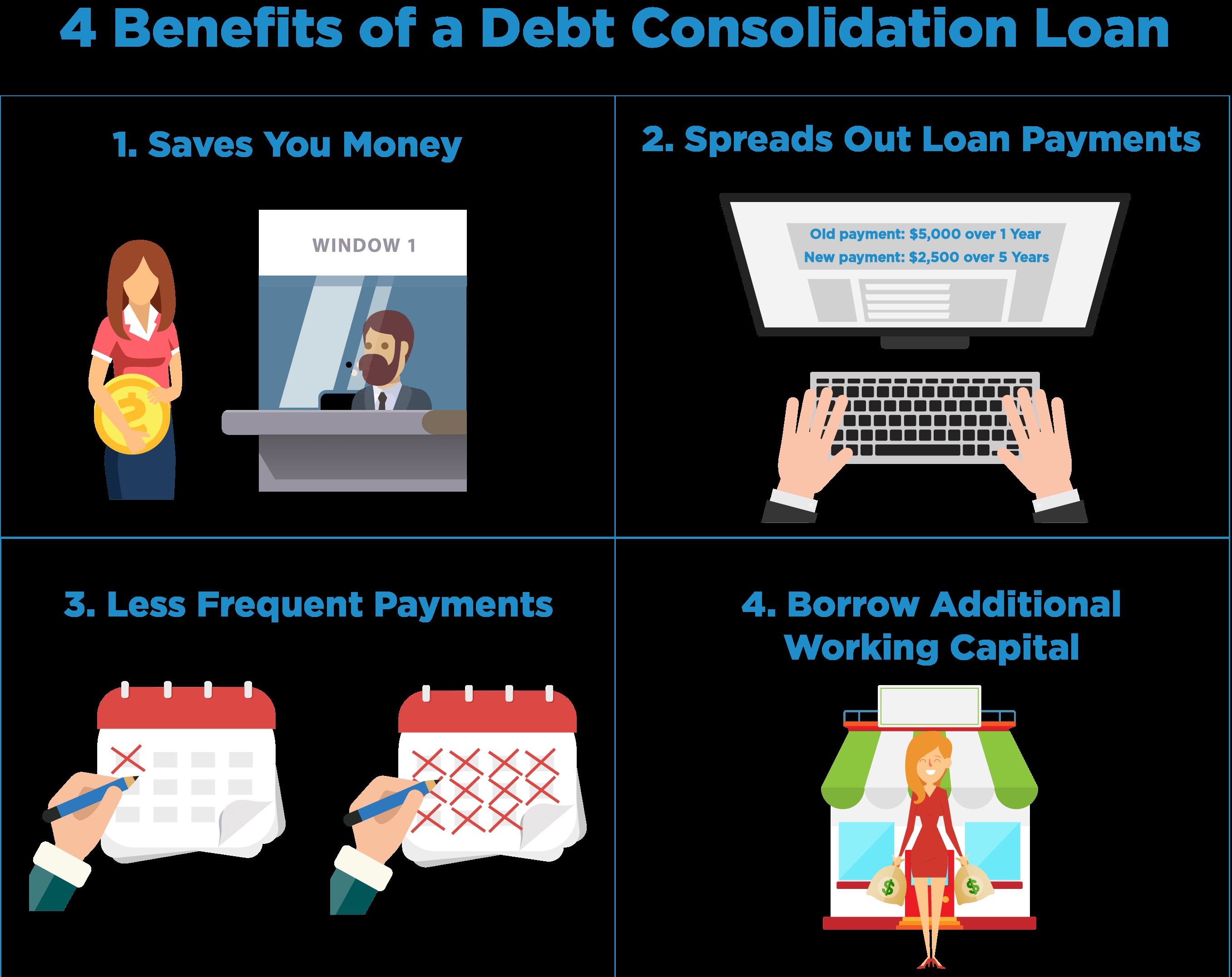

What Is Financial obligation Consolidation? Financial obligation consolidation refers to the act of obtaining a new finance to pay off other obligations and also consumer financial obligations. Numerous debts are integrated right into a single, larger financial debt, such as a car loan, generally with even more favorable reward termsa reduced rates of interest, lower regular monthly repayment, or both.

Secret Takeaways Financial obligation combination is the act of taking out a single lending to pay off multiple financial debts. Customers can apply for debt loan consolidation loans, lower-interest credit history cards, HELOCs, and unique programs for trainee fundings.

If you are saddled with various kinds of financial obligation, you can use for a finance to consolidate those financial debts into a solitary obligation and also pay them off., or debt card company for a debt consolidation car loan as their first action.

Federated Funding Partners Reviews for Dummies

, on the other hand, are not backed by properties and can be much more hard to get. They also tend to have higher interest rates and also lower qualifying amounts. With either kind of loan, interest rates are still generally lower than the rates charged on credit rating cards.

There are a number of ways you can lump your financial obligations with each other by consolidating them into a single settlement. Below are a click here for more info few of one of the most usual - federated funding partners. Financial obligation debt consolidation financings Lots of lenderstraditional financial institutions as well as peer-to-peer loan providersoffer debt loan consolidation lendings as component of a repayment plan to consumers that have trouble taking care of the number or dimension of their arrearages.

Credit cards One more technique is to settle all your credit rating card repayments right into a new credit history card. This brand-new card can be a great suggestion if it bills little or no passion for a collection duration of time.

Some Known Facts About Federated Funding Partners Bbb.

Student funding programs The federal government uses a number of loan consolidation alternatives for individuals with trainee loans, consisting of straight debt consolidation fundings with the Federal Direct Funding Program. The brand-new rate of interest is the weighted standard of the previous financings. Exclusive finances do not get this program, however. Benefits and also Disadvantages of Consolidation Loans If you are considering a financial debt combination finance there are advantages and negative aspects to take into consideration.

Longer repayment routines suggest paying much more over time. If you think about debt consolidation car loans, talk with your charge card issuer(s) to figure out for how long it will require to repay debts at their present rate of interest and compare that to the potential new car loan. There's additionally the potential loss of special arrangements on college debt, such as rate of interest discount rates and also other refunds. In a great deal of instances, this may be determined by your lending institution, who may select the order in which lenders are settled. Otherwise, pay off your highest-interest financial obligation initially. Nonetheless, if read the article you have a lower-interest car loan that is creating you extra emotional and also mental stress and anxiety than the higher-interest ones (such a personal lending that has strained family connections), you might intend to begin with that said one instead.